|  |

February 2015 | |

General meetings whose call? |

Above: A ‘mock meeting’ held as part of ORIC’s Introduction to Corporate Governance (ICG) training, Nhulunbuy ICG 2013. |

Why have meetings at all?Meetings give members an opportunity to come together face-to-face and talk about what is important for their corporation. It is at meetings where members can have a say in some important decisions about the corporation. There are a number of different types of corporation meetings. The meetings involving the members of a corporation are called general meetings and annual general meetings (AGM). |

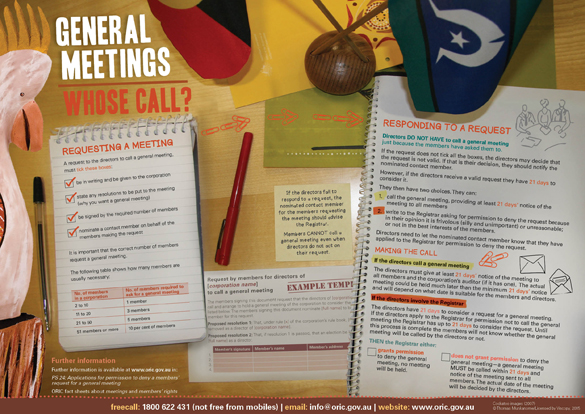

Can members call a general meeting?Members of a corporation cannot call a general meeting or annual general meeting, unless the corporation’s rule book says otherwise.

But... members of a corporation can request the directors to call a general meeting (section 201-5 of the Corporations (Aboriginal and Torres Strait Islander) Act 2006 (CATSI Act). Propose a resolution at the next general meetingIf the matter is not that urgent, members of a corporation can wait until the next general meeting or AGM to propose their resolution/s. After a valid notice of the resolution/s has been given to a corporation, it can be considered at the next general meeting as long as it takes place more than 28 days after the notice is given. The process and required number of members needed to propose a resolution at a general meeting or an AGM are generally the same as for a request to call a meeting (see centre spread). Why would members request a meeting?Some reasons why members may want to request a general meeting could be to:

These items would be included as resolutions in the request to the directors and also signed by the required number of corporation members. Members can only ask for meetings to cover general meeting business. Examples of resolutions that do not fall within the scope of general meeting business are:

If unsure about anything, remember always check your corporation's rule book. |

Read more about General meetings whose call?

TAX FILE NUMBER (TFN)Has anyone offered you cash, a free computer or other gift to sign up for an online business course?

BEWARE! Keep your TFN safe. You don’t need it to enrol in any course. ONLY give it to authorised people or organisations, like your bank, Centrelink and the Australian Taxation Office (ATO). Contact the ATO on 13 28 61 if you think you have given your TFN to someone who has no business asking for it. For more information on keeping your TFN safe, go to ato.gov.au/TFN. | Supporting ORIC corporationsThe Registrar supports Aboriginal and Torres Strait Islander corporations in various ways. The ORIC call centre (1800 622 431) has skilled people to answer queries about different aspects of a corporation’s rule book and the CATSI Act. While ORIC can provide guidance and information about a rule book and the CATSI Act, legal advice cannot be provided. If you have a legal question you will need to seek your own legal advice. The Registrar also delivers targeted and hands-on training and very practical guidance on meetings and the whole governance process needed to run a successful corporation.

Photos: ORIC staff providing information and training |

Overdue reports |

Latest report on overcoming Indigenous disadvantage released |

CONTACT ORIC: Freecall 1800 622 431 (not free from mobiles) | Email info@oric.gov.au

CHECK US OUT ONLINE: www.oric.gov.au

© Commonwealth of Australia 2015

ISSN 1836-1439 ISBN 978-1-925237-24-5 (Print) | ISSN 2203-6059 ISBN 978-1-925237-23-8 (Online)

| Attachment | Size |

|---|---|

| 14_0157_oracle FEB2015_v3-0_web_72dpi.pdf | 1.17 MB |